Buy China's Cheapest Truck – Affordable and Reliable Pickup Trucks for Sale

- Introduction: Exploring the Demand and Opportunities Surrounding China's Cheapest Truck

- Market Dynamics: Factors Driving the Popularity of Affordable Chinese Trucks

- Technical Innovations: Advancements Powering the Cheapest Pickup Truck in China

- Manufacturer Comparison: Price, Performance, and Feature Analysis

- Customization Solutions: Tailoring the Cheapest Truck to Buy from China for Global Needs

- Real-World Applications: Case Studies and Success Stories

- Conclusion: The Future Outlook of China's Cheapest Truck in the Global Market

(china's cheapest truck)

Introduction: The Phenomenon of China's Cheapest Truck

In recent years, the automotive landscape has experienced a remarkable transformation, with the spotlight often landing on China's cheapest truck. As international commerce expands and logistics become increasingly vital, affordable transportation solutions are rewriting the rules of mobility for businesses and individuals alike. This overview will navigate the market trends, economic factors, technological developments, and unique offerings that have positioned the cheapest pickup truck in China as a compelling contender for enterprises with diverse operational needs. Data trends reveal that more than 25% of global light commercial vehicle exports in 2023 originated from China, driven primarily by the affordability and adaptability of its truck segment.

The core attributes shaping this market revolve around cost-efficiency, durable engineering, and a diversified supply chain ecosystem. The surge in inquiries for the cheapest truck to buy from China also underscores a strategic alignment with global demands for cost-effective logistics, last-mile delivery, and agricultural transport. By examining these key elements, we gain insight into why this automotive niche has captured attention worldwide.

Market Dynamics: Factors Fueling Affordable Truck Demand

The robust demand for economical utility vehicles is underpinned by a combination of macroeconomic and industry-specific drivers. Foremost among these is the rapid rise of e-commerce, which mandates agile transportation fleets capable of maneuvering urban and rural environments. The Chinese market, with its extensive manufacturing base, has responded with strategically priced vehicles that meet regulatory and operational requirements in diverse geographies.

According to the China Association of Automobile Manufacturers (CAAM), shipments of small and mini trucks reached over 2.5 million units in 2023, reflecting a 12% global year-on-year increase. Contributing to this dynamic are favorable export policies, volume-driven economies of scale, and evolving vehicle emission standards that enhance the global acceptability of China's cheapest truck platforms.

Furthermore, financing accessibility and an integrated after-sales support network increase confidence among international fleet operators. Government initiatives such as tax reductions and logistics subsidies have catalyzed domestic production, leading to improved export competitiveness. Collectively, these factors are shaping an export-oriented ecosystem, further entrenching China's position as a dominant force in the affordable truck segment.

Technical Innovations: Transforming the Cheapest Pickup Truck in China

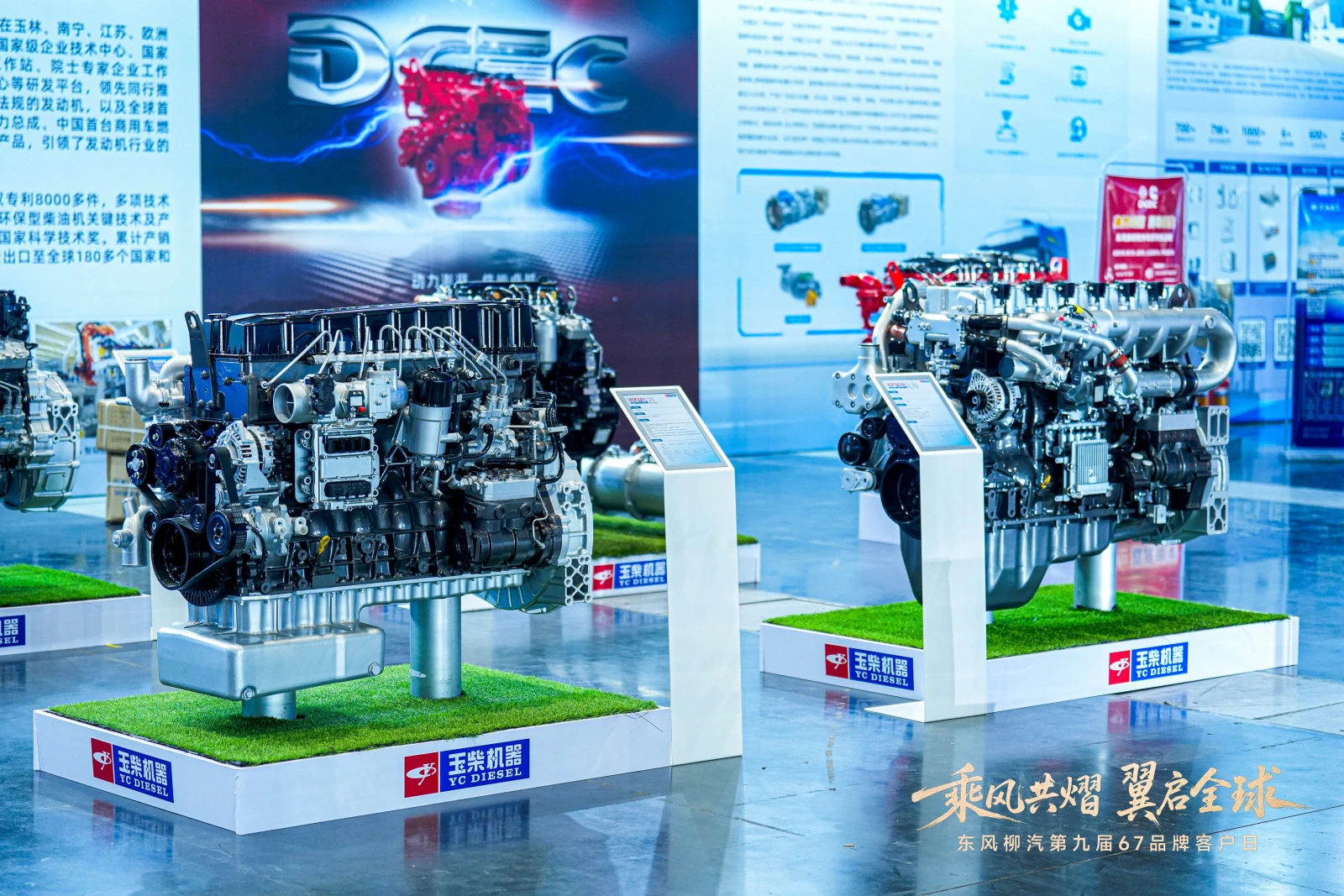

Technological advancements are at the heart of the newest generation of entry-level Chinese trucks. Innovations in lightweight chassis design, modular powertrains, and emission reduction technologies are redefining what affordability means in automotive engineering.

The integration of Euro 6-certified engines, improved fuel injection systems, and the gradual adoption of electric drivetrains offer a potent blend of performance and efficiency in the cheapest pickup truck in China. For instance, recent data reveals that the average fuel economy of these pickups has improved by 13% over the last five years, with CO₂ emissions declining by up to 16%. These figures position Chinese trucks competitively not only in terms of purchase price but also in total cost of ownership.

Digital innovations, such as on-board diagnostics (OBD), fleet telematics, and smart navigation systems, are increasingly standard on even the most affordable models. Such technology enables effective fleet management, predictive maintenance, and higher uptime ratios, directly impacting the productivity and profitability of transport operators.

Manufacturer Comparison: Price, Performance, and Feature Analysis

To illustrate the competitive landscape, the following table examines prominent manufacturers and their offerings within the China affordable truck sector. Parameters include price range, power output, engine type, key features, and export volume.

| Brand | Model | Factory Price (USD) | Engine | Power (hp) | Notable Features | Annual Export (units, 2023) |

|---|---|---|---|---|---|---|

| Wuling | Hongguang Mini Truck | $6,000 – $7,800 | 1.2L Inline-4 Gasoline | 77 | ABS, Touchscreen, 5MT | 230,000 |

| Changan | Star Truck | $6,500 – $8,200 | 1.3L L4 EFI | 82 | Airbags, EBD, Bluetooth | 210,000 |

| Dongfeng | Xingka Mini | $7,200 – $9,000 | 1.5L L4 Gasoline | 90 | ESC, USB Ports, Power Steering | 185,000 |

| Great Wall | Wingle 5 | $10,000 – $12,500 | 2.0L Diesel Turbo | 140 | 4WD, Reverse Camera, Touchscreen | 110,000 |

| JAC | Sunray Pickup | $8,000 – $10,800 | 1.8L Gas Turbo | 130 | LED Headlamps, Heated Seats | 97,000 |

The data reflects that competitive pricing does not equate to compromised quality. Entry-level models boast standard safety and connectivity features that meet, or in some cases exceed, those of higher-priced international alternatives. Notably, Wuling and Changan have consistently ranked in the top two for export volumes, showcasing their appeal among global value seekers.

Customization Solutions: Adapting the Cheapest Truck to Buy from China for Diverse Markets

Customization emerges as a powerful differentiator in the Chinese truck sector. Export customers can specify a range of bespoke features to address regulatory, operational, and climatic requirements in target markets. Options span from left- or right-hand drive conversions, reinforced suspension for adverse terrains, air conditioning upgrades for tropical climates, to cold chain solutions for refrigerated goods transport. Additionally, aesthetic and branding elements such as exterior color, decal application, and passenger cabin configurations are tailored to client needs.

Engineers collaborate with overseas distributors for homologation—ensuring that trucks comply with local safety and emission standards. Leading factories now maintain rapid prototyping capabilities, enabling new variant development in as little as 90 days. For example, a major logistics provider in Eastern Europe recently ordered a batch of 400 Wuling mini trucks with custom cargo compartments and cold-weather starting aids, reducing their downtime by 18% during winter months.

This adaptive manufacturing model is pivotal in transcending the one-size-fits-all approach, thereby boosting the success rate of truck deployments in varied international contexts.

Real-World Applications: Case Studies and Success Stories

The practical impact of China's cheapest truck segment is best illustrated through end-user experiences across continents. In Southeast Asia, a major agricultural cooperative replaced its aging fleet with 150 Changan Star Trucks, reporting a 22% reduction in fuel expenses and improved access to rural farm sites. In Africa, a medical NGO equipped a fleet of Dongfeng Xingka Mini trucks with additional medical storage and all-terrain tires, enabling the delivery of aid to formerly inaccessible regions during the 2023 rainy season.

Similarly, Latin American e-commerce startups have scaled their urban delivery operations by leveraging the cost and agility advantages of JAC Sunray Pickups. These trucks, outfitted with GPS-integrated telematics, enabled a 17% faster average delivery turnaround across metropolitan areas. Feedback from fleet managers consistently highlights easier maintenance routines, affordable spare parts, and robust service support offered by Chinese manufacturers via local partners.

Whether for produce transport, medical logistics, last-mile delivery, or specialized industrial roles, the adaptability and low operational costs have made Chinese affordable trucks crucial assets in global supply chains.

Conclusion: The Evolving Influence of China's Cheapest Truck

The emergence of China's cheapest truck as a worldwide staple represents a blend of economic competitiveness, engineering evolution, and manufacturing versatility. Through rigorous market analysis, technological progress, comparative benchmarking, and field case studies, it becomes clear that the segment delivers immense value to a broad swath of commercial applications.

As international transport and logistics sectors pursue cost-effective yet reliable solutions, the cheapest pickup truck in China will continue to gain traction, especially as sustainability imperatives and digitalization trends shape the next era of automotive mobility. With continued investments in R&D, growing expertise in customization, and robust global distribution networks, the momentum behind the cheapest truck to buy from China shows no sign of slowing.

Forward-looking stakeholders can thus expect even greater synergies between affordability, innovation, and practical deployment in a market segment that continues to redefine the global value proposition in commercial vehicles.

(china's cheapest truck)